USPS mail price hikes driving away more customers than predicted, study finds–Federal News Network

Press

USPS mail price hikes driving away more customers than predicted, study finds

USPS is underestimating how much recent mail price hikes are driving away some of its biggest customers, an industry report finds.

The Postal Service has raised mail prices five times since December 2020, when its regulator granted new pricing flexibility — and may soon be asking for a sixth increase that would go into effect this summer.

But a new industry report warns USPS is underestimating how much these rate hikes on its monopoly mail — or “market-dominant” — products are driving away some of its biggest customers.

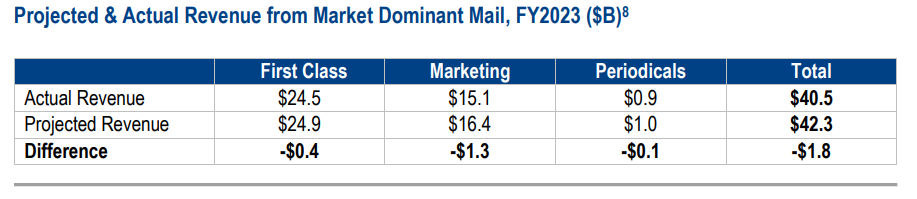

A report from Keep US Posted — a nonprofit group of consumers, nonprofits, newspapers, greeting card publishers, magazines, catalogs and small businesses — finds market-dominant revenue in fiscal 2023 fell $1.8 billion short of the Postal Service’s own forecast, “signaling a potential issue with the model used to defend rate increases.”

“The inability to accurately predict the impact of rate increases on market dominant products threatens the stability of the USPS’ volume and revenue base,” the report states.

Join us Mar. 26 and 27 at 1 p.m. EST for Federal News Network’s DoD Cloud Exchange where we’ll be hosting leaders from across Defense along with industry tech experts to get in the weeds on the latest policy initiatives, real-world implementations and latest technology developments. | Register today!

The report warns that continued rate increases “put the USPS at risk of accelerating volume decline and losing revenue on these products.”

‘To mail or not to mail’

The report, commissioned by the Greeting Card Association and the Association for Postal Commerce (PostCom), and conducted by NDP Analytics, comes just weeks before USPS is expected to ask its regulator, the Postal Regulatory Commission, to approve a sixth rate hike.

USPS in January raised the price of a first-class stamp from 66 to 68 cents. The agency is settling into a familiar routine of biannual rate increases for its monopoly mail products each January and July.

Mike Plunkett, former USPS manager for pricing strategy and innovation and manager of retail alliances, now president of PostCom, said the study shows USPS has “underestimated the rate at which they would lose [mail] volume.”

“The size of the [price] increases — and almost as importantly, having two increases a year — has changed mailer behavior, because of the magnitude of the increases, and the fact that now twice a year, mailers have to go to their finance people and say, ‘Hey, rates are going up again.’ Twice a year, you have to have another discussion about how can we possibly get out of the mail for a more affordable channel,” Plunkett said in a recent interview.

Rafe Morrissey, GCA’s vice president of government affairs, said the repeated rate hikes force businesses to ask themselves whether “to mail or not to mail.”

“These volume declines really represent an existential challenge for the Postal Service and the industry that depends on it,” Morrisey said.

The Postal Regulatory Commission in December 2020 gave USPS the flexibility to set monopoly mail prices above the rate of inflation.

Read more: Agency Oversight

USPS expects mail decline to continue, calls study ‘deeply flawed’

Postmaster General Louis DeJoy has repeatedly said USPS is making full use of this pricing flexibility, which the agency requested more than 15 years ago, when the agency started reporting major annual net losses.

DeJoy says USPS needs to keep raising higher mail prices at an “uncomfortable rate,” to offset past inflation and correct for 15 years of a defective pricing model.

Meanwhile, USPS sees a continued drop in first-class mail volume, and expects those trends will continue.

DeJoy, in a December 2023 letter to congressional leaders, said total mail volume fell by 42% between 2007 and 2020. Total mail revenue, during that same period, fell from $60.6 billion in 2007 to $38.7 in 2020 —a 36% drop.

“This trend will continue,” DeJoy told lawmakers.

Despite a steady decline in mail volume, it remains a significant source of revenue for the agency’s bottom line. According to the study, market-dominant mail accounts for 56% of its revenue.

The Postal Service’s package business brought in more than $31 billion in revenue last year—more than 40% of its total revenue.

Want to stay up to date with the latest federal news and information from all your devices? Download the revamped Federal News Network app

DeJoy says USPS growing its package business is the key to turning around the agency’s long-term financial problems.

USPS spokesperson David Coleman said in a statement that, “as inflationary pressures on operating expenses continue and the effects of a previously defective pricing model are still being felt, price adjustments have provided the Postal Service with much-needed net revenue to achieve the financial stability sought by its Delivering for America 10-year plan.”

Coleman said that to evaluate price elasticity, “the Postal Service continually updates and improves its estimates of how mail volume responds to price changes and other factors, and those estimates have been filed with the Postal Regulatory Commission for decades.”

Coleman added that USPS prices “remain among the most affordable in the world,” and that “NDP’s critique and proposal appear to be deeply flawed.”

Is a ‘short-term’ approach creating ‘long-term’ challenges?

USPS estimates demand for its monopoly mail products through a model that includes 40 custom equations.

However, the report claims USPS is basing its stamp hikes on a demand model that underestimates the elasticity, or price sensitivity, of its consumers.

“Generally speaking, the Postal Service’s market-dominant products are demand-inelastic, meaning when you raise prices, you generally get more revenue and don’t lose as much volume as you would if demand was elastic,” Plunkett said.

The report finds USPS customers are mailing less in response to the rate hikes, and at a higher rate than what the agency expected.

“They’re seeing larger decreases than their models predicted, because of that error,” Plunkett said. “They’ve taken a short-term, aggressive approach that has created some long-term challenges.”

The report also warns that customers who now send less mail because of higher prices are less likely to return to their old habits, even if prices stabilize.

“Ignoring price sensitivity may boost revenue in the short run, but USPS must retain volume to achieve and maintain solvency in the long run,” the report states.

Morrissey said GCA previously worked with USPS over a three-year period to grow greeting card mail volumes through cooperative marketing. But those gains went away when USPS raised prices.

“That immediately reversed those volume gains and took them below the preceding three years where we started,” Morrisey said.

DeJoy recently outlined its plans to Congress to cut costs by $5 billion over the next two years, and grow revenue by roughly the same amount. He told lawmakers these plans are necessary to get USPS back on track to achieving its “break-even” goals.

But Plunkett said those plans to break even are harder to achieve, when mail volume is falling faster than what USPS has predicted.

“When you get a sudden, unexpected decline in volume, the Postal Service is not able to keep up with that,” he said.

Plunkett added that USPS labor costs, which account for about 70% of total USPS costs, haven’t fallen as quickly, in response to a decline in mail volume.

“As a result, they’ve deepened the hole that they’re in, and have made it that much harder for them to get back to break even. In fact, looking at where we’re headed for 2024, it’s hard to see a path back to breakeven anymore,” Plunkett said.

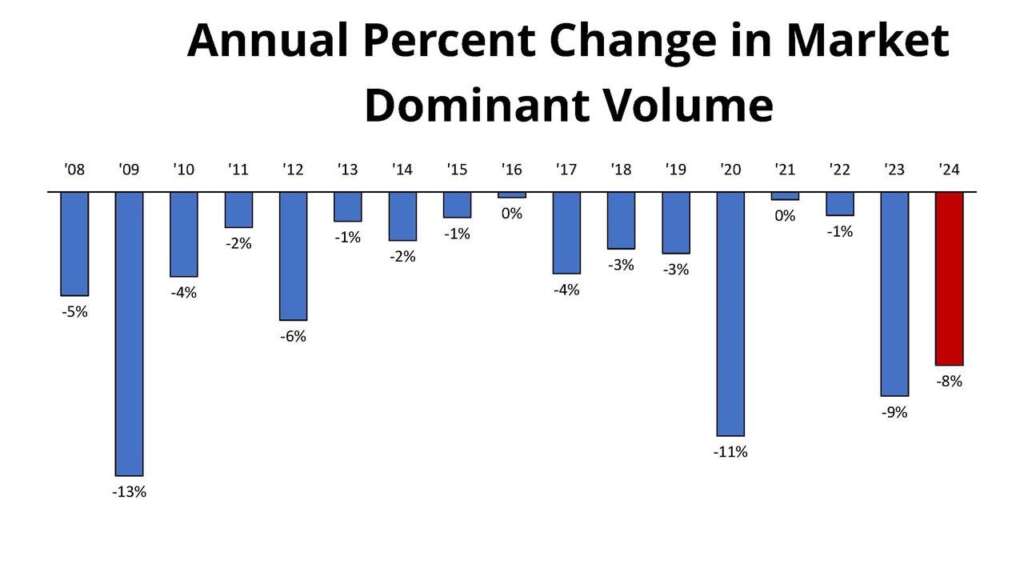

Steve Kearney, executive director of Alliance of Nonprofit Mailers, and a former USPS treasurer and vice president of pricing, said volume declines in 2023 and projected for this year are much larger than all previous years, except for the Great Recession in 2009 and the COVID-19 pandemic in 2020.

Taking out those two years, market-dominant volume dropped an annual average of 2.4% between 2008 and 2022. That’s much less than the 9% decrease USPS saw in 2023, and the 8% drop in volume the agency is projected to see this year.

(Sources: USPS Cost and Revenue Analysis and USPS FY 2024 Integrated Financial Plan)

“The study verifies what many mailers already know in their guts. The Postal Service is damaging its current finances, its long-term solvency, and many of the mailers that fund the agency with market-dominant mail. It would be very irresponsible to continue digging a deeper hole based on flawed information,” Kearney said.

Kearney said another rate hike in July could be an “ugly tipping point” for many mailers.

“It will be a big mistake if postal management and the Governors continue to make and approve rate increase decisions based on flawed models that measure history well but have no track record with the current practice of above-inflation rate hikes at a semi-annual frequency,” Kearney said.

Incentives to grow mail volume ‘not the best success story’

As for the Postal Regulatory Commission, Plunkett said “they’ve been very slow to react to what is an unfolding catastrophe.”

PRC officials, however, say that efforts to incentivize mail volume growth over the past few decades have run into a few challenges.

USPS, since the early 2000s, has entered into specialized contracts, called negotiated service agreements, with mailers and shippers. Under these NSAs, USPS offers a discount to businesses or organizations that commit to sending a large volume of mail or packages.

Congress, in the 2006 Postal Accountability and Enhancement Act, codified the Postal Service’s ability to offer NSAs.

“The idea is to allow some innovation, to encourage mail volume, and keep mailers in the system,” a PRC official said in a recent interview.

The Postal Regulatory Commission, since the 2006 law, has approved only 10 negotiate service agreements for mail, but has approved thousands of NSAs for its competitive package businesses.

PRC officials said half of those mail NSAs didn’t result in a net financial benefit for USPS, and were stopped. Only two of the remaining five NSAs, they added, clearly made money, while the remaining three produced “unclear results.”

“They have not been the best success story,” the PRC official said.

USPS faces a lower bar for its regulator to approve an NSA for packages, compared to offering a similar discount on bulk mail delivery.

The PRC official said an NSA for packages needs to cover the cost of the product offered and contribute to the Postal Service’s institutional costs to get approved.

“There have been a ton of them,” the PRC official said. “The postmaster general is really emphasizing packages. And we’ve seen that with the flow of NSAs, which has been increasing, and the commission has been turning those around very fast.”

However, the regulator needs more evidence to approve an NSA for mail. The NSA has to cover its own costs, but also improve the net financial position of USPS or improve its performance, and without causing any harm to the overall postal market.

USPS, as part of any mail NSA, also has to ensure that the same deal is available to similarly situated mailers.

“The overall policy goal here is to make sure that these deals with a particular party don’t disadvantage other users of the mail system,” a PRC official said.

The PRC official said most proposed NSAs for monopoly mail products lack evidence of how the deal will improve the Postal Service’s net financial position.”

“We’re aware of the issues. Is there going to be a magic bullet that solves this issue of mail volume? No. Can this be part of the answer? Absolutely,” the official said.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED