Board of Governors Meeting Highlights Polarized Views of Louis DeJoy and His Ten-Year Plan

Today’s USPS Board of Governors meeting illustrated the strong polarization of options about Postmaster General Louis DeJoy. On the one hand, we had the Trump-appointed majority Governors, senior postal officers, and DeJoy himself giving highly-scripted endorsements of the PMG and his plan.

The defense of the plan included stinging rebukes of the postal leaders who preceded DeJoy, customer “stakeholders” who advocated for their own needs and prevented the agency from operating like a well-oiled machine, the postal regulator that presided over a deficient pricing system for 15 years, and Congress that failed to act on an obvious crisis within the agency. In other words, they had to take these difficult actions to save the agency because everyone before them screwed up so badly. DeJoy, his majority Board of Governor supporters, and the remaining postal officers know better than everyone else was the message.

Bizarre Board Chairman Vote

In one of the strangest moments in modern postal history, the majority of the board insisted on reelecting Ron A. Bloom as chair even though his one-year holdover term expires in less than a month on December 8. The only way Bloom gets to carry on as chairman is if President Biden re-appoints him as a USPS Governor.

Even more unusual, the majority refused to let newcomer Governors Anton G. Hajjar and Ronald A. Stroman initiate a discussion by the board of its nomination of Bloom. The majority very obviously rushed through the nomination and vote so that the opponents could not raise questions or objections. They made a show of consulting with the secretary of the board, Michael J. Elston, on Roberts Rules of Order. In more collegial times a discussion would be a clear choice.

Public Comment Period is Mostly Critical

After the orchestrated board agenda, the USPS proudly opened the first public comment period since before the pandemic. They had required that commenters register online well in advance. The Postal Service also seemed proud to expand the comment period from 30 to 60 minutes. They said 33 people registered so each would be strictly limited to 90 seconds, and no responses would be given by the board.

When the roll call played out for ten in-person commenters and 23 remotes, only 18 answered the bell. Of those, 15 were mostly critical of the ten-year plan. They included USPS union employees, Oshkosh Defense union employees, and representatives of various public advocacy groups. Many criticized the slowdown of First-Class Mail service and its impact on seniors, voting, rural residents, and those without broadband access. Likewise, postal rate-making drew much disagreement for the size of increases as well as their unpredictability and frequency.

The most basic disagreement seemed to stem from the vision of the USPS as a “business,” “company,” and “going concern,” all terms used during the meeting by the Board of Governors and postal officers, versus the commenters who described a public service that unifies and meets basic needs of US citizens, postal employees, and organizations that depend on mail with reliability and affordability that the private sector cannot provide. Until that difference in vision is reconciled, it will be difficult to make real progress with our postal system.

Postal Official Predicts July 2022 Rate Increases of 5.9% to 7.9%

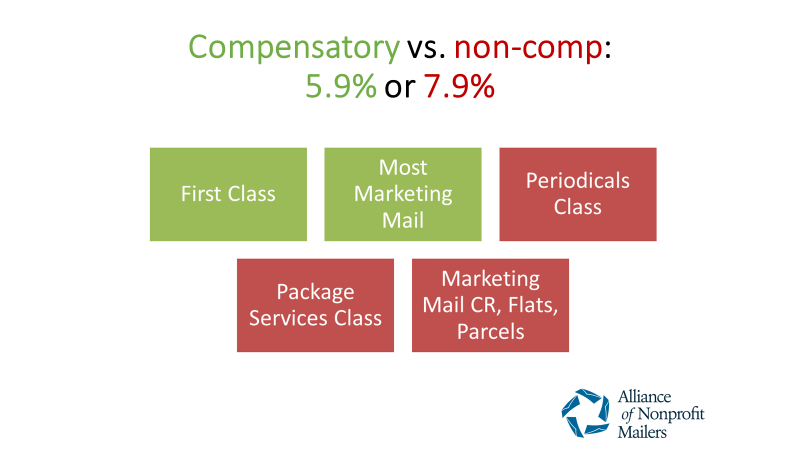

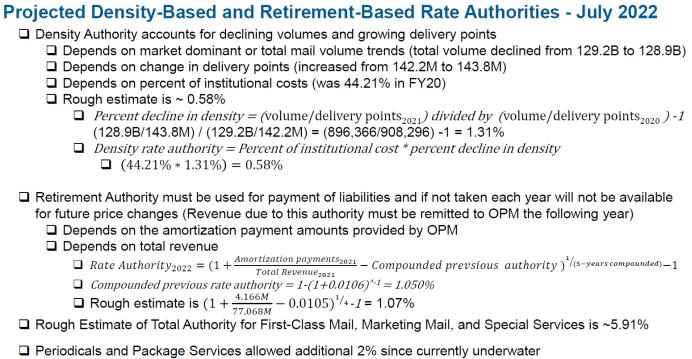

USPS VP of Pricing and Costing Sharon Owens last week provided rough estimates of 5.9 percent average for compensatory and 7.9 percent average for noncompensatory products and classes next July. The two main variables are the Consumer Price Index and the mail density measure created by the Postal Regulatory Commission. Owens broke down the increases as follows:

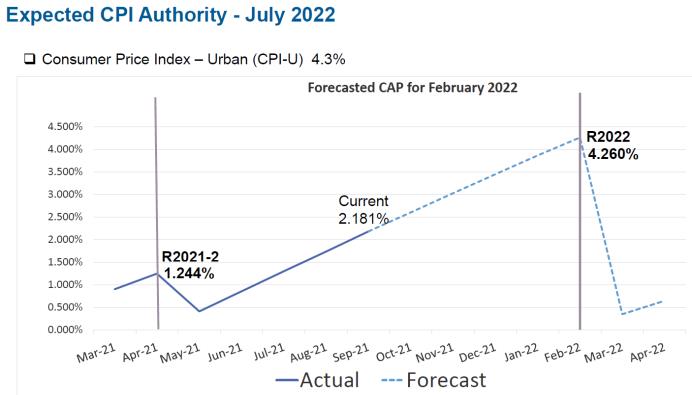

CPI (10 months) 4.26%

Density (FY 2021) 0.58%

Retirement 1.07%

Compensatory 5.902%

2.000%

Non-compensatory 7.902%

These increases are similar to those implemented earlier this year in two stages. The contributions of CPI and mail density have reversed themselves somewhat with higher inflation and more stable density as volume rebounded in 2021.

To describe the USPS thinking behind rate increases, Owens shared the following:

“The Postal Service intends to be judicious in the use of available

pricing authority, but anticipates the prospect that, given

our current financial condition, the price change for each Market

Dominant class may be required to apply most or all pricing

authority. July 2022 rate authority will include ten months of

CPI plus retirement, density, and non-compensatory class authorities

as determined by the Postal Regulatory Commission.

The January rate authority will include six months of CPI, plus

any unused rate authority. Subsequent July prices will include

six months of CPI plus the retirement, density, and non-compensatory

class authorities.”

Following July 2022, the USPS plan is to raise rates based on six months’ CPI every January, and six months’ CPI plus the PRC add-ons every July. The add-ons are mail density, retirement funding of about 1 percent, and non-compensatory make-up of 2 percent.

The following chart shows the build-up of the CPI cap to February 2022 which is when USPS would file the July 2022 rate hikes. The current 2.181 percent CPI cap shown does not include today’s announcement of the year-over-year jump of 6.2 percent in October, the biggest inflation surge in more than 30 years. There is a risk that inflation will be even higher than the Postal Service predicts. The opposite movement of inflation and mail density ensures very large rate increases the first two times USPS uses the new authority granted by the PRC. That is unless the Alliance wins its appeal of the new rules in the U.S. Court of Appeals.

USPS Reports $4.9 Billion Loss for FY 2021

The Postal Service did much better than both the ($9.7 billion) “Base Case” loss and the “Delivering for America Plan Annual Net Loss” of ($9.4 billion) for FY 2021 that the agency predicted in its ten-year plan. Today, CFO Joseph Corbett reported a loss of ($4.9 billion) at the Board of Governors meeting.

USPS did not include as income the $10 billion grant it received from Congress to offset costs related to the pandemic. It did of course include all costs it incurred. If the $10 billion grant were included as income, USPS would have netted a $5.1 billion profit in FY 2021.

IAS 20 Accounting for Government Grants and Disclosure of Government Assistance states: “An entity recognizes government grants only when there is reasonable assurance that the entity will comply with the conditions attached to them and the grants will be received. Government grants are recognized in profit or loss on a systematic basis over the periods in which the entity recognizes as expenses the related costs for which the grants are intended to compensate.”

USPS and its auditors decided that Generally Accepted Accounting Principles allow it to not report the grant income as income, but still report the costs that Congress offset.

The ($4.9 billion) reported loss compares to a ($9.2 billion) loss the prior year. The Postal Service also reported two other versions of its loss:

FY 2021 FY 2020

| Net loss | $ | (4,930) | $ | (9,176) |

| Loss excluding workers’ compensation adjustments | $ | (6,855) | $ | (7,571) |

| Controllable loss | $ | (2,386) | $ | (3,752) |

For FY 2022, CFO Corbett projected a loss of ($8.4 billion), or a loss of ($1.2 billion) if USPS gets the legislative and administrative changes it is asking Congress and the Administration for. Separately in the ten-year plan, he predicted a loss of ($11.7 billion) base case or ($2.2 billion) with the Delivering for America Plan

Leave a Reply