Alliance Report

May 31, 2023

Issue 23/06

The leading voice for nonprofits on postal issues for over 40 years.

© 2023 Alliance of Nonprofit Mailers—All rights reserved.

A 501 (c)(4) nonprofit organization established by nonprofits for nonprofits.

For the first time, a USPS rate hike on monopoly mail does not yield more revenue; and competitive packages are not helping

It always had been axiomatic that whenever the U.S. Postal Service raised rates the agency received most of the price increase in new revenue. For example, if USPS raised rates 10% it would get a 9% boost in revenue. This is known as low own-price elasticity.

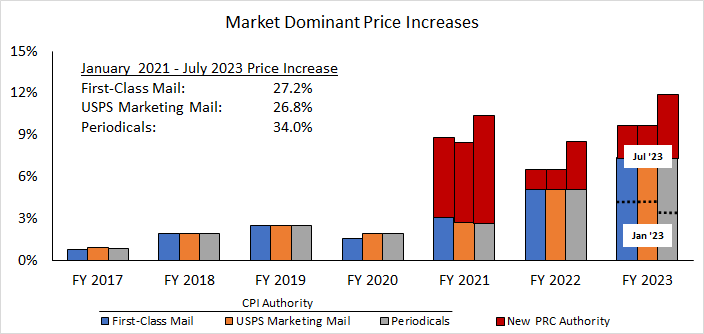

As we know, the Postal Service has broken the mold for how much and how often it increases postage rates. For a long time from 1970 to 2006, it was every three years in line with inflation. Then, with the Postal Accountability and Enhancement Act, from 2007 to 2020 it became once a year in line with inflation.

Now the mail agency is raising rates twice a year well above inflation that happens to have been at a 40-year high.

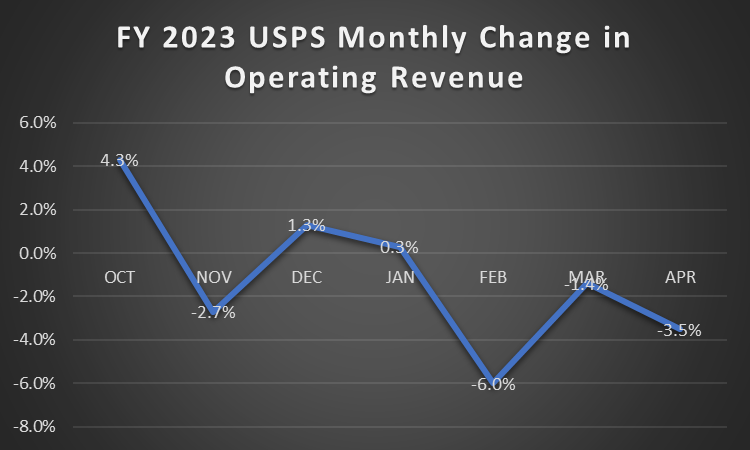

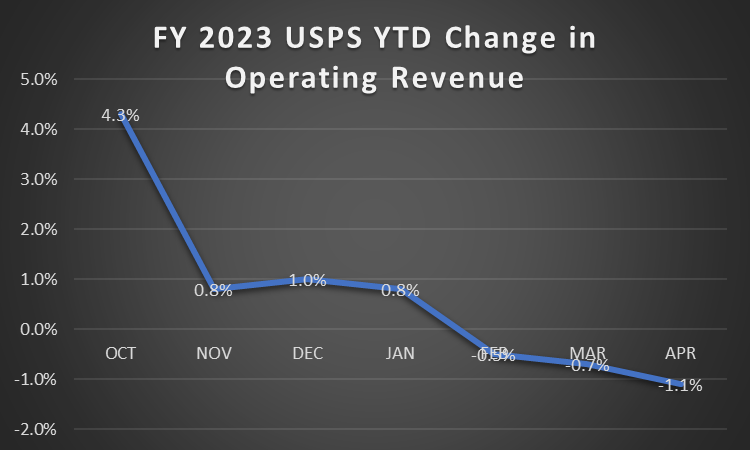

The shocking thing that is happening is that USPS revenue is declining after large rate increases. In four of the seven months in Fiscal Year 2023, operating revenue growth has been negative:

The three months following the latest rate increase in January have been negative. As a result, year-to-date operating revenue is now negative:

It is possible, even probable, that USPS has reached the limit of its ability to raise rates with impunity. Management has been grasping at straws by citing potential non-price causes of lower mail volume such as a pull-back on advertising spending. But the word from many mailers is that the cost of mailing, and the uncertainty about whether this nightmare will end, are forcing drastic actions to reduce and eliminate volume.

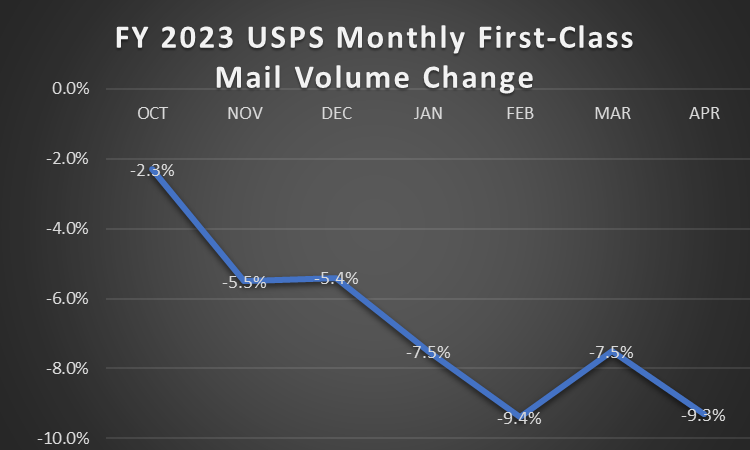

The monthly trend in First-Class Mail volume this year is very troubling and it got worse after the January rate hikes:

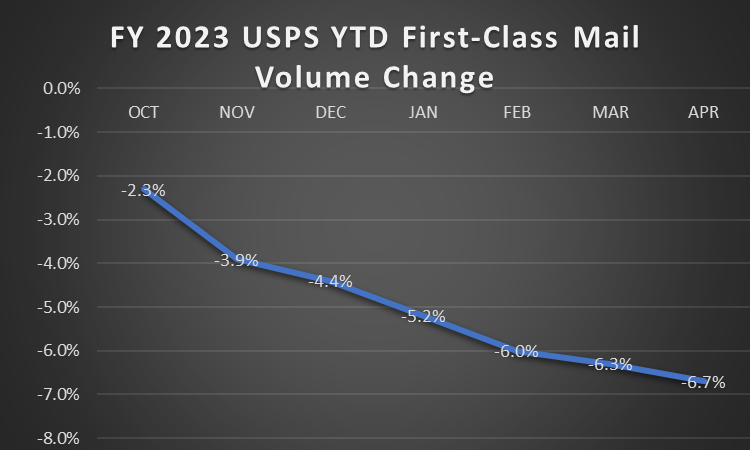

As a result, the year-to-date decline rate for First-Class Mail has quickly tripled:

According to mailers, this trend is a direct result of the cumulative impact of semi-annual rate increases well above already-high inflation and uncertainty about where this will lead and when it will moderate.

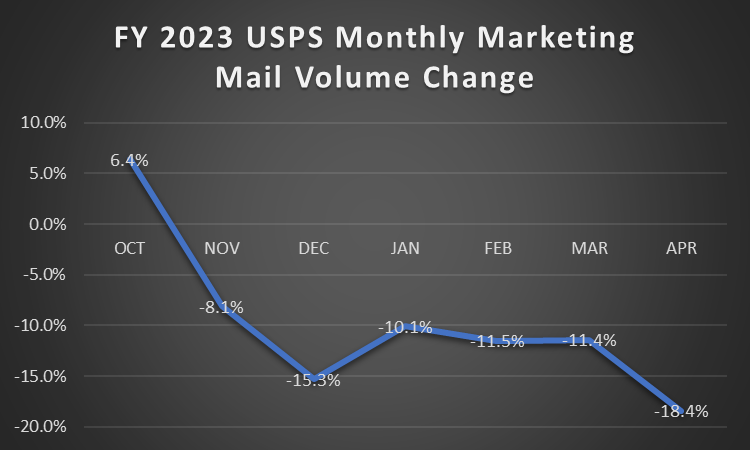

The trend in monthly USPS Marketing Mail volume this year is equally or even more concerning:

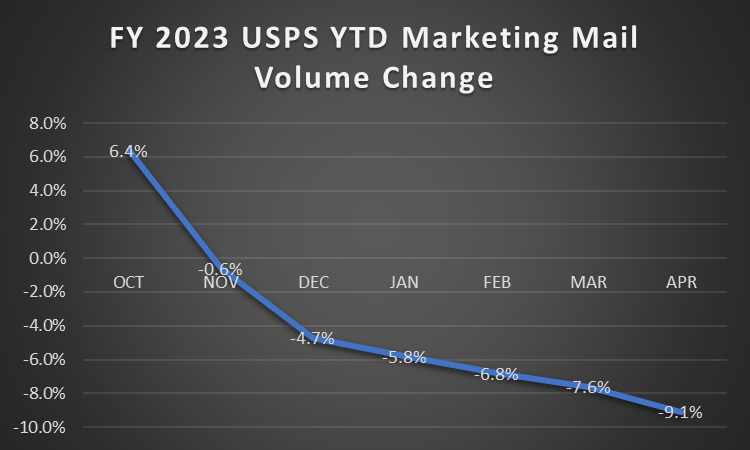

Year-to-date, USPS Marketing Mail appears to have fallen over the slippery slope. It is hard to believe that moderation in the growth of advertising accounts for this drop-off:

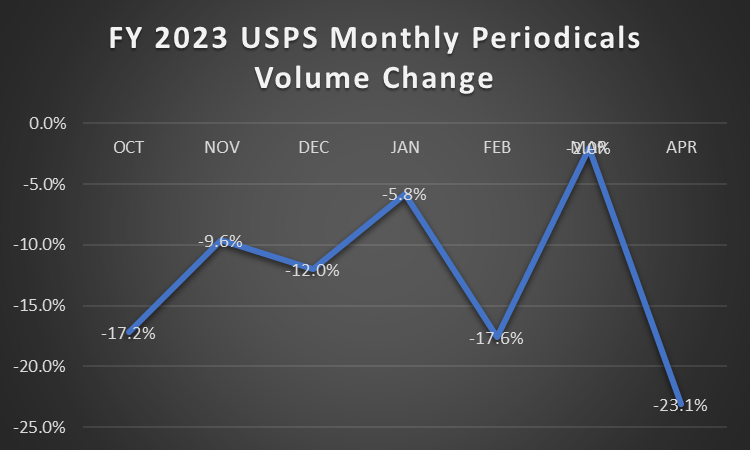

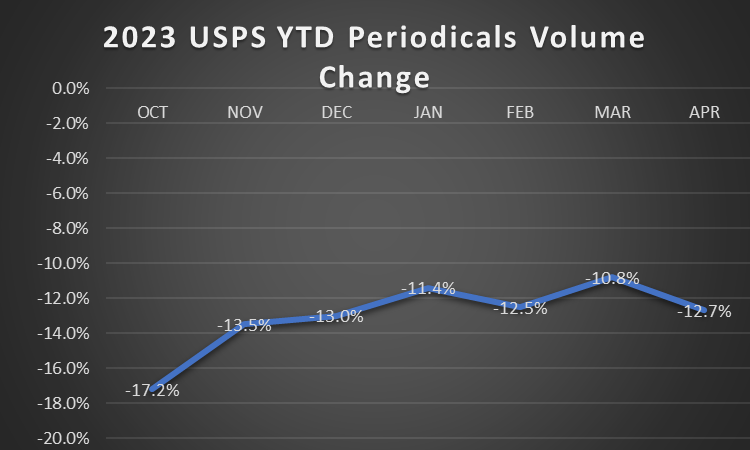

Periodicals have been hit especially by rate increases augmented by the new Postal Regulatory Commission rule that they go up 2 percentage points above inflation once a year. There also is a long lead time to phase out the mailing of Periodicals because of subscription commitments.

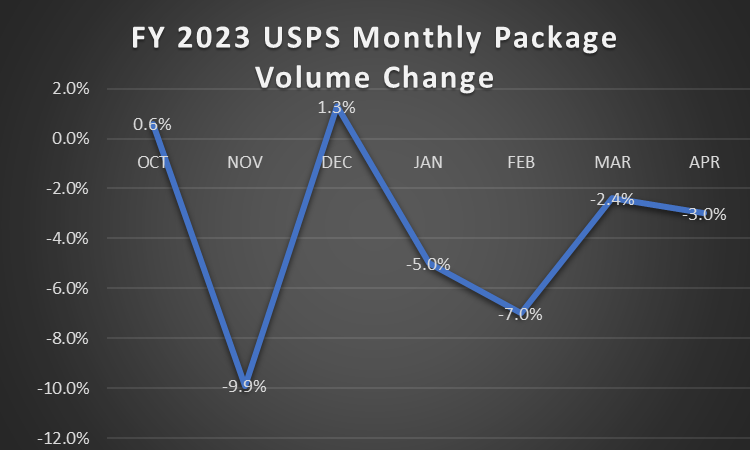

The Postal Service Delivering for America strategic plan relies on strong growth in the competitive package services as the agency becomes the “preferred package delivery service.” The thought is that this side of the agency would help cover the costs of naturally-declining mail.

Well, it’s not happening yet with package volumes:

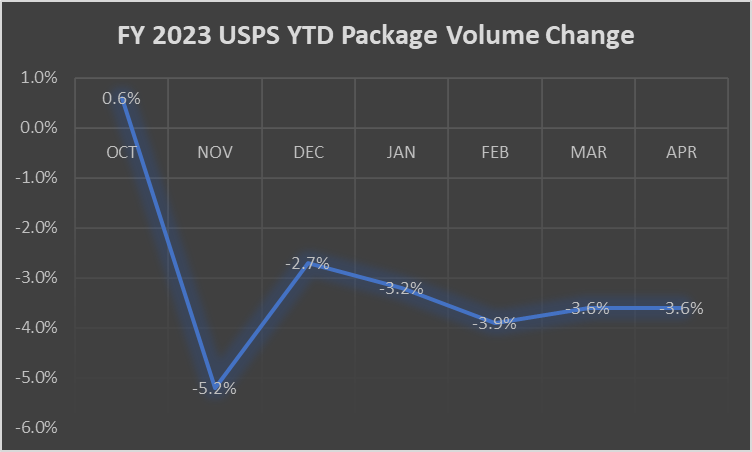

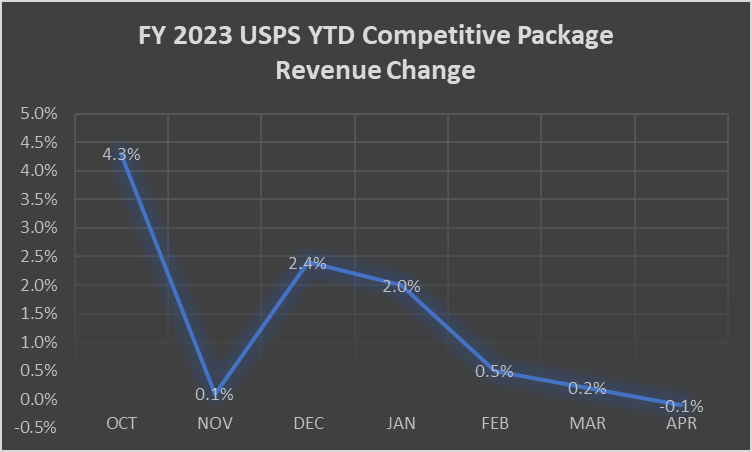

Year-to-date, USPS competitive packages have not found a growth path:

Perhaps the pricing freedom that USPS enjoys for competitive packages, with no regulatory cap, is enabling the agency to make new revenue despite anemic volume.

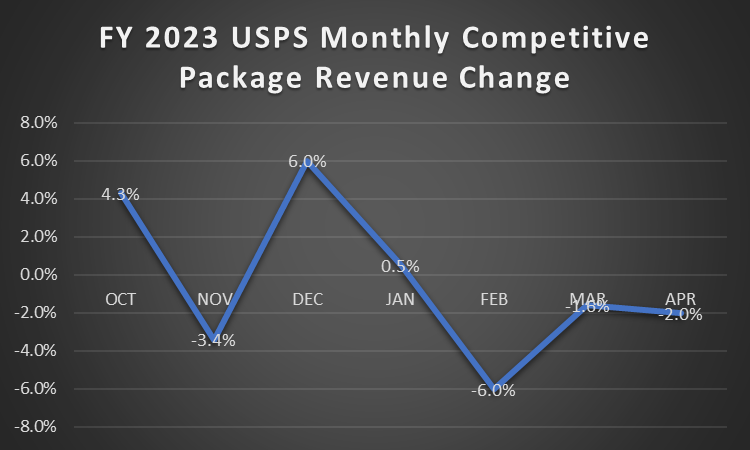

Well, not so far:

Year-to-date, competitive package revenue is down 0.1%, not enough to stand on its own much less subsidize the mail side of the agency:

The PRC today approved the USPS proposal for more large rate increases in July. The regulatory agency makes it clear that its approval is based on compliance with the law and the rules it set up to allow inflation-plus price increases on monopoly mail. The foundational assumption underlying the rules allowing rate hikes above inflation is that they will improve the USPS’s financial stability.

That is not happening. With the precipitous drop in mail volume and no growth in packages, USPS finances are deteriorating rather rapidly. The Postal Service has lost $4.1 billion seven months into the fiscal year that it planned to achieve break-even two years ago.

The one near-term action to try to stop the bleeding, that USPS is sure to decline, would be to defer the rate increases planned for July. Even if the rate increases yielded more cash, which is now doubtful, USPS does not need the extra cash this year and maybe next. The agency is holding about $19 billion in its U.S. Treasury Postal Service Fund account. Even with heavy spending on facilities and vehicles, the agency would not burn through that much excess cash.

By deferring rate hikes, USPS would retain the authority to raise rates later when it needs cash and likely when inflation has subsided. A system of “banking” unused rate authority is well-established by the PRC.

It is difficult to understand why such a seemingly obvious choice is not even under consideration by the Postal Service.

Leave a Reply