-

The good news for mailers: CPI inflation is moderating

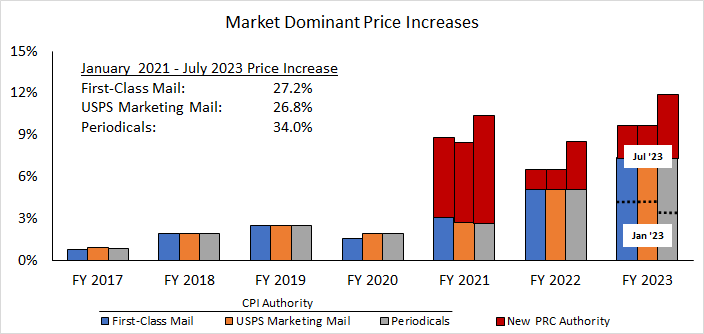

The latest Consumer Price Index (CPI) released today is very positive for mailers. As we know, much of the recent postage rate increases have been based on the CPI. You can see this in the non-red, lower segments of the bar chart below.

We expect CPI to move back to where it was for several years, close to the Federal Reserve’s 2% target. The main focus will shift back to the regulatory add-ons to inflation. The Postal Regulatory Commission created the add-ons to the CPI cap set up by Congress in 2006. The regulator, with the backing of USPS, intended to improve the “financial stability” of the Postal Service by increasing the mail agency’s operating revenue.

As we prepared for the July 9 “Market Dominant” mail rate increases, the available rate authority for the planned January 2024 rate hikes was 1.1%. There were three more CPI releases before the cap for January is set: on July 12, August 10, and September 13.

The PRC has not yet updated the rate authority incorporating the June CPI. Nevertheless, the January 2024 CPI postage rate cap is likely to be in the 2-2.5% range, with non-compensatory products like Marketing Mail flats required by the PRC to go up at least 2% more than the cap. It’s cold comfort with the July hikes upon us, but we need to look ahead.

July 2024 rate hikes will be much worse, however, as the PRC allows the USPS to add something like 4-5% on top of the CPI as a reward for pushing mail volume down so much this year. This is known as the “mail density adder.” As fewer pieces are delivered to a growing number of addresses, the density of mail drops, and therefore the USPS cost to deliver each piece increases.

Through May, Market Dominant mail volume was down 8.6% for the first eight months of fiscal year 2023. But the trend is getting much worse, with May down 11.3%.

Hypothetically as an example, if Market Dominant mail volume ends up down 10% for FY 2023, the PRC would add about 4.5% to USPS rate authority in July 2024.

July 2024 also will include both the extra 2% for non-compensatory products like Marketing Mail flats as well as the 2% add-on for Periodicals as a class of mail.

Any time in the future, the USPS Governors could exercise some business judgment and not use the full rate authority granted by the PRC. But that has not happened before, except for very small fractional amounts. Unused rate authority is “banked” for future use, so it’s not a case of “use it or lose it.”

-

The bad news for USPS/PRC: Rate hikes are not improving Postal Service finances

In its May 31 decision to approve the latest USPS rate hikes for July 9 implementation, the PRC reiterated that it purposely gave the Postal Service rate authority above inflation to improve the mail agency’s “financial stability.” Here is one of the regulator’s justifications:

Several commenters argue that the Postal Service’s decision to use nearly all of its rate adjustment authority and the resulting amount of the increases are excessive and unreasonable. However, the Commission found that giving the Postal Service the means to raise prices by amounts greater than previously permitted (which was limited to the change in inflation absent extraordinary or exceptional circumstances) was necessary for the achievement of financial stability, and the Commission targeted the new forms of rate authority to address discrete sources of costs over which the Postal Service does not have direct control.

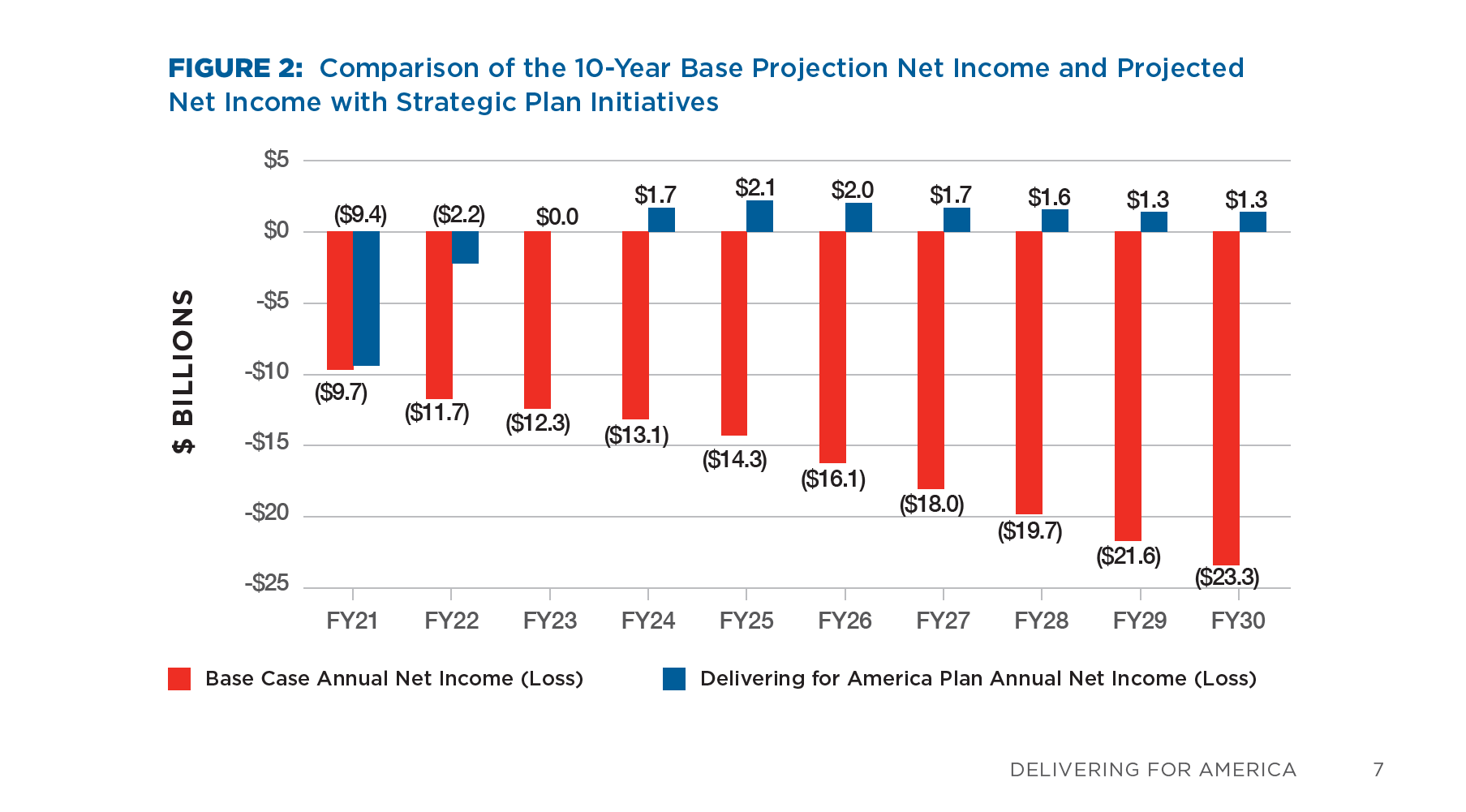

The problem is that the pricing strategy of raising rates frequently and in large amounts is not improving USPS’s financial stability. Whereas the “Delivering for America” strategy predicted breakeven in fiscal year 2023, the USPS “Integrated Financial Plan” for FY 2023 projected a loss of ($4.5 billion).

Eight months into FY 2023, the USPS loss is at ($4.765 billion), presaging a much worse year than the IFP predicted about six months ago.

The extra rate authority is supposed to achieve financial stability by boosting operating revenue. The USPS piled on and doubled down on the PRC’s generosity by unilaterally announcing it would raise rates twice a year, something never done before.

We had a large set of rate hikes in July 2022, less than three months before FY 2023, and another set in January 2023, a third of the way into the year. And of course, we have been anticipating the next price increases that just took place with three months left in the fiscal year.

Quad Impact_of_5_July_2023_Rates (002)

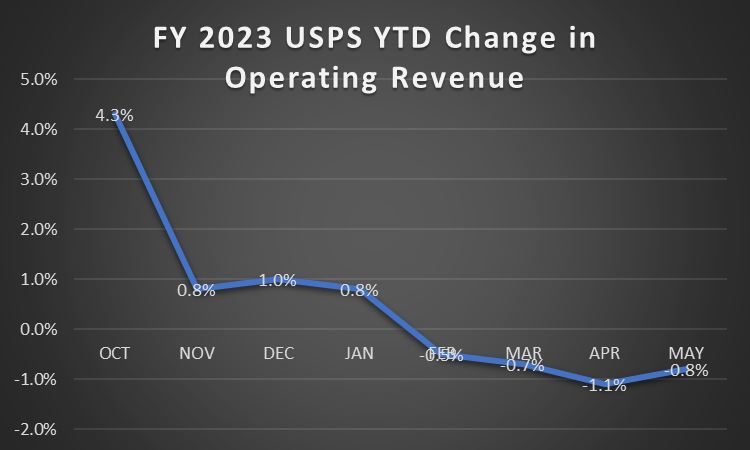

So how has the new pricing model built by the twin postal agencies PRC and USPS doing? The most direct financial impact of large price increases should be a healthy boost in operating revenue.

If a pricing model that employs unprecedented rate increases twice a year yields a decline in operating revenue, it surely is defective. This never happened before with the long-held pricing model of keeping rate increases in line with the general inflation of prices in the U.S. economy. Yet even with these results in front of them, and the ability to bank rate authority for future measured use as inflation subsides, USPS management and the independent Postal Service Governors continued with the failed pricing model.

Mailers who strongly urged the Postal Service from over-using its full rate authority twice a year are now left to watch and wait to see the extent of the continuing damage that the flawed pricing strategy wreaks. Soon we will see the USPS financial results for June which will be the last month before the latest price adjustments.

-

Inspector General finds that USPS is not doing enough to control flat mail costs; PRC continues to require at least 2% extra price increases and USPS goes farther

A new report by the Inspector General called “Flats Cost Coverage” found:

We found most Postal Service initiatives are not designed with specific, measurable objectives to directly reduce Flats cost and do not address the causes of inefficiencies in Flats operations identified by the PRC. In addition, we identified opportunities for the Postal Service to further collaborate with its stakeholders on current and new initiatives related to Flats.

The IG recommended:

We recommended management further collaborate with stakeholders from the mailing industry to develop and implement initiatives with specific, measurable objectives to directly reduce Flats costs and address the causes of inefficiencies in Flats operations identified by the PRC.

Even though the IG specifically checked on “inefficiencies in Flats operations identified by the PRC” and said USPS is not adequately addressing them, the PRC continues to require that USPS raise flats’ rates at least 2 percentage points more than the cap on the class of mail.

In practice, USPS has been increasing flats rates much more than an extra 2%:

Nonprofit Marketing Mail Flats Piece Piece/Lbs.

January 2021 +0.11% +1.75%

August 2021 +13.45% +12.06%

July 2022 +12.71% +9.72%

January 2023 +9.85% +8.66%

July 2023 +8.57% +8.18%

Compounded Jan 21-Jul 23 +52.67% +47.058%

Source: Quad

First-Class Mail flats have increased even more in price over these 2-1/2 years, at +66.32%.

Why continue to penalize mailers when the PRC identifies extensive USPS inefficiencies and the OIG finds that the Postal Service is not doing enough to control flats costs? Why only try to cover costs with massive rate increases that will push more volume out of flat mail?

The management response from USPS disagreed with the independent assessment that the agency is not adequately controlling flats’ costs and said it will continue to do what it is doing, saying that “(t)he Postal Service must balance the cost of creating data with the benefit.”

-

USPS launches major package initiative: Ground Advantage

As we have noted for some time, the crux of the USPS’s ten-year strategy is to make up for losses in the delivery of declining mail by increasing its market share, volume, and profitability in the delivery of packages.

Announced with much ballyhoo on July 10, Ground Advantage was touted by the agency as a “game-changer.”

In an exuberant press release headed “Introducing Ground Advantage,” the PMG laid down the gauntlet:

“USPS Ground Advantage is a game changer – for our customers, the industry and USPS. By efficiently and effectively integrating our ground transportation model to the magnificence of our last mile delivery operations, we can now offer the most compelling ground shipping offering in the market,” said Louis DeJoy, United States Postmaster General and CEO. “With USPS Ground Advantage, we are ready to compete for an increased share of the growing package business.”

GA replaces and reconfigures several pre-existing USPS offerings: USPS Retail Ground, USPS Parcel Select Ground, and USPS First-Class Package Service as well as Ground Returns and First-Class Package Return Service.

The agency described how GA fits into its overall strategy:

USPS Ground Advantage is a key element of the Postal Service’s shipping service growth strategy as part of the 10-year Delivering for America plan. A new shipping portfolio – comprised of USPS Ground Advantage and USPS Connect Local and Regional – positions USPS to compete very effectively for any package under 25 pounds that can be transported by ground, within a region across states, and across the country.

USPS Ground Advantage Key Features

- Packages delivered in 2-5 business days across the continental United States.

- Free package pickup service at home or in-office.

- Business customers can use USPS Ground Advantage return service as a convenient option for customers who need to send items back.

- $100 insurance included on USPS Ground Advantage and USPS Ground Advantage Return packages. Customers can purchase up to $5,000 in additional coverage.

News coverage described the initiative as an effort to wrest packages currently delivered by rivals such as FedEx and UPS by rebranding and offering lower prices.

Leave a Reply