September 20, 2017

Alliance represents all nonprofits in opposing USPS proposal to change preferred rates

- At stake: Nonprofit Marketing Mail rate increases of 3.3% to 6.9% on top of other increases

- USPS filing attempts to solve nonexistent problem

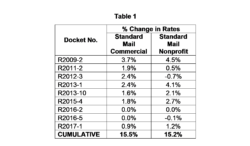

The Alliance of Nonprofit Mailers, as it always does, took a strong position to support and protect the rights of nonprofit mailers. We pointed out, as no one else did, that over the last ten years, nonprofit and commercial Standard Mail prices have gone up at virtually the same rate: 15 percent. This means that there is not a problem in need of fixing. (See Table 1.)

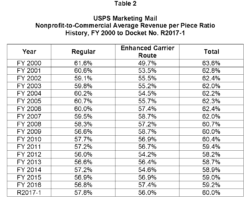

Following the 2006 postal law change known as PAEA, the Postal Service itself proposed to change the calculation of nonprofit preferred rates. The new law eliminated so-called “subclasses” of mail, such as Regular and Enhanced Carrier Route. From 2000 through 2006, the USPS and Postal Regulatory Commission targeted nonprofit revenue per piece to equal 60 percent of commercial for each of these subclasses.

With no more use of subclasses, the USPS switched in the 2008 rate case to calculating the 60 percent compliance for the whole Standard Mail class. This Postal Service initiative was done with the approval of commercial mailers, nonprofit mailers, and the PRC.

Then, out of the (postal) blue, the Postal Service decided in the middle of 2017 that it wants to go back to subclasses, even though they have fallen out of use.

The USPS justified its proposition as follows: “Such an approach is consistent with the language of the statute, and will help alleviate an ongoing problem: a failure to reach 60 percent in the Nonprofit-to-Commercial average revenue per piece ratio, at the subclass level, due to a different mail mix between Nonprofit and Commercial.” The Postal Service does not really explain why it considers the current method an “ongoing problem” other than saying nonprofits would pay higher rates under their proposal.

The fact that both nonprofit and commercial prices have risen at the same rate since the 2008 change indicates that it is not an “ongoing problem.” Further, the Postal Service’s own table shows that the lower percentages for subclasses also occurred for the eight years before the 2008 change to measuring the full class. (See Table 2.)

A really good question is, why is postal management expending resources on an initiative like this with everything that is at stake for USPS and its customers?

Summary of Alliance Comments in Opposition

- Nothing Has Changed: The Commission should keep its existing methodology for calculating the 60 percent ratio between nonprofit and commercial Marketing Mail rates. Since 2000, 39 U.S.C. § 3626(a)(6) has required that Marketing Mail rates be set so that the average revenue per piece from each nonprofit “subclass” equal, “as nearly as practicable,” 60 percent of the average revenue per piece from “the most closely corresponding regular-rate subclass of mail.” In 2008, after the enactment of the PAEA led to the elimination of separate rate subclasses, the USPS persuaded mailers and the Commission that the soundest way to comply with the law was to apply the ratio to nonprofit Standard Mail as a whole vis-à-vis commercial Standard Mail as a whole. The USPS has given no good reason for abandoning this conclusion.

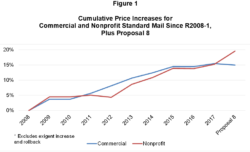

- No Harm Done: While the Postal Service is correct that class-wide application of the 60 percent ratio tends to produce lower nonprofit rates than does applying the 60 percent ratio separately to regular and ECR mail, this relationship was evident in 2008, when the Postal Service persuaded the Commission to adopt the class-wide method. The relationship between nonprofit and commercial Marketing Mail rates has been remarkably stable since then: the cumulative rate increases for commercial and nonprofit Marketing Mail have been nearly identical.

- Major Damage to Nonprofits: The newly-minted USPS interpretation of the law would violate one of the fundamental policies of the 2000 legislation: to protect nonprofit mailers from unpredictable rate fluctuations. The proposal would force an average price increase of 6.94 percent for ECR nonprofit Marketing Mail and 3.33 percent for regular nonprofit Marketing Mail—in addition to any CPI-based price increases taken under 39 U.S.C. § 3622(d)—and cause the cumulative rate increase for nonprofit Marketing Mail since 2008 to be much higher than for commercial mail. This unexpected financial hit would have a devastating effect; the resources of nonprofit organizations are already stretched thin. Even the Postal Service acknowledges that its proposal could produce “rate shock” for nonprofit mailers. The cumulative increase since 2008 would be four percentage points higher for nonprofits than commercial mailers. (See Figure 1.)

- Future Manipulation Likely: Adoption of the current Postal Service proposal would also make nonprofit price levels more vulnerable to manipulation in the future through changes in classifications, mail preparation requirements, and rate designs. Within recent years, changes in the Domestic Mail Manual—in particular, the implementation and subsequent withdrawal of FSS rates—have shifted billions of pieces from the Carrier Route product to the Flats product and back again. Other changes—e.g., adjusting piece minimums for Carrier Route Basic Flats or discouraging co-mailing by reducing the Carrier Route Basic discount —would also shift mail between the proposed pseudo-subclasses, potentially affecting the nonprofit ratio if applied separately to each pseudo-subclass.

The Alliance filing was backed by dozens of letters from nonprofits in opposition to the USPS reversal of current policy. The message rings loud and clear that this completely unnecessary change would knock substantial nonprofit fundraising out of the mail and endanger countless charitable missions that our nations needs now more than ever.

Our opposition was joined by the DMA Nonprofit Federation and the Data & Marketing Association, representing both nonprofit and commercial mailers. The DMA insightfully pointed out that the PRC itself recently certified that the setting of nonprofit preferred rates has been in full compliance with the law:

The Commission should not allow USPS to take this backward step. In fact, USPS conveniently ignores the most recent Commission finding concerning preferred postage rates. On page 41 of the Annual Compliance Determination for Fiscal Year 2016 the Commission stated, “The Commission finds that prices in FY20I6 were in compliance with all of the preferred rate requirements identified in 39 USC section 3626. “ [emphasis added] The Commission should not allow an accounting change that requires the use of former definitions that have been eliminated by PAEA to alter prices that are otherwise in compliance with the law. Moreover, it would be a significant change to the current CPI rate-setting process which has served all mailers well for over ten years.

The Commission has known since 2008 that applying the 60 percent ratio to Standard Mail as a whole produces lower nonprofit rates than would applying the ratio separately to “regular” and “Enhanced Carrier Route” Standard Mail. Indeed, a major commercial mailer, Valpak, specifically pointed this relationship to the Commission in the Annual Compliance Review Proceeding for 2008. Docket No. ACR2008, Valpak comments (Jan. 30, 2009) at 57, Table 8; Annual Compliance Determination, Fiscal Year 2008, pp. 62-63.

Yet the Commission has held in every year since 2008 that the result of applying the 60 percent test on a class-average basis satisfied 39 U.S.C. § 3626(a)(6). For example:

- “The Commission finds that in FY 2013, prices were in compliance with all the preferred rate requirements identified in 39 U.S.C. § 3626.”

– Annual Compliance Determination, Fiscal Year 2013, p. 39.

- “The Commission finds that prices in FY 2014 were in compliance with all the preferred rate requirements identified in 39 U.S.C. § 3626.”

– Annual Compliance Determination, Fiscal Year 2014, p. 32.

- “The Commission finds that prices in FY 2015 were in compliance with all of the preferred rate requirements identified in 39 U.S.C. § 3626.”

– Annual Compliance Determination, Fiscal Year 2015, p. 41.

- “The Commission finds that prices in FY 2016 were in compliance with all of the preferred rate requirements identified in 39 U.S.C. § 3626.”

– Annual Compliance Determination, Fiscal Year 2016, p. 41.

There is no defined schedule for the PRC to render a decision on this “backward step.” Nonprofit mailers can file it with all the other factors causing the highest level of pricing uncertainty in USPS history. It is puzzling why USPS keeps adding to the uncertainty which costs volume and loyalty.

Leave a Reply